In a previous post, “How to Use Dynamics GP Unit Accounts to Enhance Your Management Reports,” we talked about how companies can use Unit Accounts for statistical data to track a company’s performance in Dynamics GP. Any non-financial or statistical data that is tracked and reported on could potentially be set up as a Unit Account. In Dynamics GP, Unit Accounts can be used to breakdown or allocate costs at a more granular level, which provides management a clearer picture of how various areas of the company are performing.

Predominantly, companies want overhead expenses such as rent or utilities separated by department, location, project, or product. Frequently, the process for allocations is manual with the calculation done in Excel and manually entered into the General Ledger. This manual process may be even more inefficient if the allocation entry is not recorded at the same time as the expense. To help, this process can be automated in Dynamics GP using data in Unit Accounts with Variance Allocation Accounts.

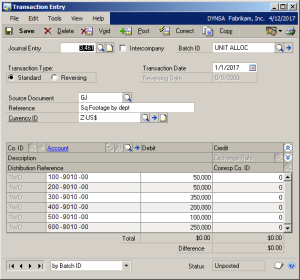

For example, a company decides to allocate rent expense each month by department based on square footage. At the beginning of the year, square footage for each department is determined and the amounts are entered into unit accounts (Financial>Cards>Unit Accounts.)

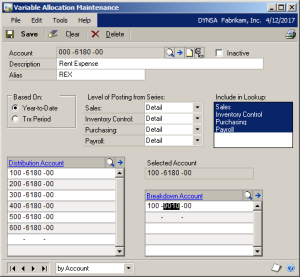

A variable allocation account (Financial>Cards>Variable Allocation Account) is set up with distribution (posting) accounts for each department. Each distribution account is linked to a breakdown account. In this example, the breakdown account is the unit account for square footage.

Note: A breakdown account can be either a unit account or posting account.

When a transaction is posted to the variable allocation account, an amount is apportioned to the distribution accounts based on balance in the breakdown account, or unit account. In this case, Dynamics GP will distribute an amount based on the square footage recorded in the unit accounts, which is shown below.

Note: The distribution percentages for a variable allocation account will change if the balances of the breakdown accounts change.

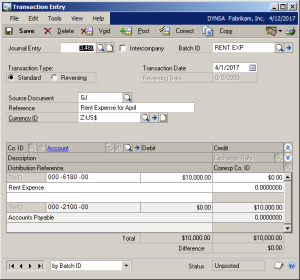

The expense amount is recorded to the variable allocation account and the transaction is posted. When a transaction is posted to any variable account, the system automatically records the appropriate amounts to the distribution accounts. No amount is actually posted to a variable allocation account.

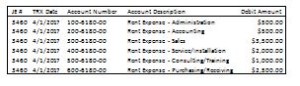

A search by journal entry number returns the following results showing the original expense amount of $10,000 divided among the departments.

Utilizing Dynamics GP Unit Accounts with Variable Allocation Accounts will save time and improve efficiency by automating the allocation process.

For additional information, contact the ERP experts at Boyer & Associates here.